倒挂的收益率曲线

倒挂的收益率曲线(Inverted Yield Curve)

倒挂的收益率曲线是指短期证券的收益率高于长期证券收益率的一种图形,与正常收益率曲线刚好颠倒。在正常的收益率曲线中,长期收益率较高,以反映持有证券较长时间的风险。

倒挂收益率曲线一方面可能反映短期票据的过剩,因票据过剩压低价格而抬高收益率;另一方面也可反映长期证券的短缺或市场对长期证券异常强劲的需求——其结果会抬高价格而压低收益率。此外,这也可反映人们预期长期的通货膨胀将低于短期的通货膨胀,最后导致收益率下降。

收益率曲线的形状是根据连上在直轴不同国库债券收益率点以及在横轴的债券年期点而成。收益率曲线是分析利率走势和进行市场定价的基本工具,也是进行投资的重要依据。国债在市场上自由交易时,不同期限及其对应的不同收益率,形成了债券市场的“基准利率曲线”。市场因此而有了合理定价的基础,其他债券和各种金融资产均在这个曲线基础上,考虑风险溢价后确定适宜的价格。

倒挂的收益率曲线则是从左向右下滑,反映短期收益率高于长期收益率的异常情况。在正常情况下,收益率曲线从左向右上升,因为年期越长收益率会越高,以反映投资风险随年期拉长而升高的情形。就这种收益率曲线而言,若长期收益率的升幅大于短期收益率,收益率曲线会变陡。

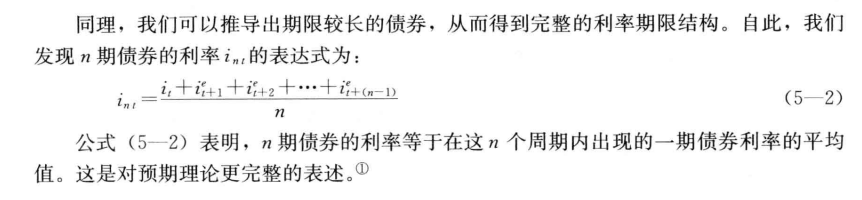

(1)The expectations theory of the term structure states the following commonsenseproposition: The interest rate on a long-term bond will equal the average of the shortterm interest rates that people expect to occur over the life of the long-term bond.

当短期收益率较低时,人们认为长期收益率要高,从数学的角度出发,相当于从小到大排数,平均数在中位数的右侧,图形上显示,收益率曲线向上走。

当短期收益率较高时,人们认为短期的收益率要回到低位来,从数学的角度,相当于从大到小排数,平均数在中位数的右侧,图形上显示,收益率曲线向下走。也就是倒挂。

(2)The key assumption of the segmented markets theory is that bonds of different maturities are not substitutes at all, and so the expected return from holding a bond of one maturity has no effect on the demand for a bond of another maturity. This theory of the term structure is the opposite extreme of the expectations theory, which assumes that bonds of different maturities are perfect substitutes.

(3)The liquidity premium theory of the term structure states that the interest rate on a long-term bond will equal an average of short-term interest rates expected to occur over the life of the long-term bond plus a liquidity premium (also referred to as a term premium) that responds to supply and demand conditions for that bond.